The beginnings AKA the genesis tick

In the beginning, there was liquidity.

Automated market makers are a staple of the DeFi space. Although still in their infancy and with their own limitations, they enable essentially anyone to create markets seamlessly and efficiently.

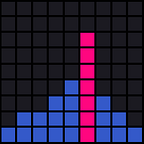

As we move towards a more capital efficient ecosystem and iterate upon the baseline formula of x * y = k, we arrive at the paradigm of concentrated liquidity. This is where LP’s are introduced to pooling assets within a concentrated custom price range, enabling them to provide the same liquidity depth as v2 within specified price ranges, while putting far less capital at risk.

This, however, is not always the actual case.

Due to the novelty of concentrated liquidity coupled with the gas fees for repositioning, most liquidity is pooled in way too wide a range. The wider the range, the bigger the opportunity cost as this liquidity sitting in dead ticks could be better placed into other protocols (eg: loans, options vaults,..) where it can be more effectively used, or more actively managed.

Passive liquidity will start to atrophy or see their capital drained away as more advanced (and better capitalized) predators such as arbitrageurs or more active market makers take in the majority of the yield. As L2’s evolve towards cheaper fees, more protocols and liquidity pairs may move to cheaper protocols, and individual high-volume asset pairs may even shard off into their own dedicated L2s. If so, ticks will become tighter until they become single-price, fully concentrated flip-orders (similar to orders on a conventional limit-order book) rather than range-orders. Concentration is likely the future of most on-chain marketplace liquidity, further shifting the balance between passive and active liquidity.

As passive liquidity pooling gets pressed against the wall, seems like there is no route in sight to enable these smaller players to keep abreast, or is there?

“In the land of the blind, the one-tick man is king”

Where there is inefficiency, there is an opportunity and we are set out to explore it, as a community, and as a DAO. Enter OnetickDAO.

OneTickDAO is being ignited to take advantage of, and to share the advantages offered to concentrated liquidity across various DeFi programmes and DEXes today, essentially a collective of ideas to provide better concentrated liquidity management, and to create better tools for this purpose. For now, it is first being bootstrapped as a DAO to experiment with and explore these ideas, as well as an initial play at a few focused concentrated LP opportunities.

Much like Fuse allows anyone to “create their own Compound”, OneTick should allow anyone to create their own bespoke liquidity management strategies, forking and configuring strategies similar to Charm and Visor’s to deploy and use them based on their own needs.

The “Tickening” — from liquidity prey to apex predator

“Wen onetick, sir?”

Soon fren. As you can see, we got a pretty hefty vision to accomplish, but we do gotta start somewhere, right? That’s exactly what we did.

To kickstart our community and our proof of concept towards a market fit, we are proud to show you some sneak peeks of what our V1 platform will be looking like.

In a nutshell, regular DeFi users will be able to take advantage of smart concentrated liquidity strategies, using simple liquidity Vaults where users can pool into. These vaults can later evolve to support multiple concentrated strategies or even custom-tailored strategies created by community members and made available on our platform.

We’re deploying from start on two of the main Ethereum L2’s: Polygon and Arbitrum. But we will be expanding to virtually all EVM chains, especially the ones who have more sensible fees to undergo this sort of management without eating away into profits aggressively.

What’s the plan, then?

Over the course of the coming 3/4 weeks, we’ll be undergoing our platform launch in a three-stage process:

- Alpha launch — available for internal/core team testing, undergoing at the moment — we’ll be pooling our own capital to test out the flows and usability of our product;

- Beta launch — a semi-closed beta launch, for all of our chad community members and early supporters — you will be able to deploy your own funds to become a part of the onetick fam and help us write history;

- MVP launch — full public launch — no restrictions, no barriers, just ape.

After this, OneTickDAO can evolve in several directions, but starting from now, we evolve together.

Want to discuss liquidity and build new cool strategies? Join our discord and chat with us: https://discord.gg/UWP6pX3s